To address whether governments should be involved in business, we need to first understand the types of goods they provide. Generally, goods fall into three categories:

Private Goods: These are goods and services already provided by the private sector. Examples include Pakistan International Airlines (PIA), competing in the airline industry alongside private airlines, and Pakistan State Oil (PSO) in the oil and gas sector, which operates alongside private competitors.

Semi-Private Goods: These are partially provided by the government and the private sector. The power sector is a good example—while some electricity is generated by government entities, most comes from private Independent Power Producers (IPPs).

Public Goods: These are essential services like roads, education, and infrastructure. When the private sector fails to provide these, it’s generally accepted that the government should step in to ensure their availability.

From this, we can conclude that the government’s role should be limited to public goods, and only as a last resort. But how does this theory hold up in Pakistan?

1. Introduction to State Owned Enterprises in Pakistan

Pakistan currently has 113 State-Owned Enterprises (SOEs), many of which are deeply unprofitable. In fact, the loss-making SOEs have accumulated a total loss of $4.1 billion. For context, Pakistan’s annual spending on education is around $2.8 billion, and $3.3 billion on health. The government is spending 50% more on loss-making SOEs than on either education or health.

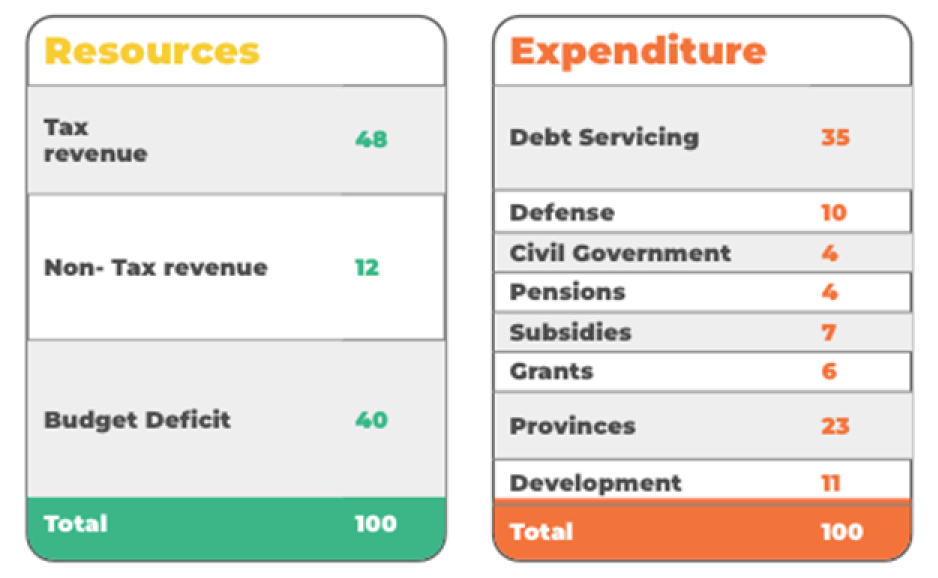

Let’s focus on the five largest loss-making SOEs.

Figure 1: Loss Making SOE 2018 – 2022

The five biggest Loss Making State Owned Enterprises are National Highway Authority, Pakistan International Airlines, Quetta Electric, Pakistan Railway and Peshawar Electric Supply Company. Collectively, these SOEs have lost Rs 1863 billion between 2018 and 2022, with the National Highway Authority alone accounting for Rs 832 billion of the losses.

2. Performance of PIA

PIA is Pakistan’s most well-known SOE, but also one of the most controversial when it comes to privatization.

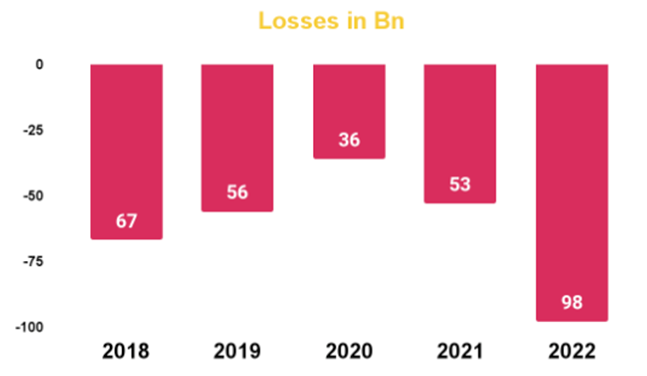

Figure 2: PIA Net Loss 2018 – 2022

Between 2018 and 2022, PIA suffered a net loss of Rs 310 billion (about $1 billion), with the worst year being 2022, when it lost Rs 98 billion.

Post COVID ticket prices were very high and during this time airlines were earning record profits. During this time most airlines were making Gross Profits of about 15%-20%; however during this time PIA was already at a loss of -0.4% at the Gross level which only subtracts direct expenses from revenue.

Another important metric to evaluate the performance of airlines is Employee-to-Aircraft Ratio. This metric tells us for every one plane, how much ground staff is there. Generally private airlines are more efficient when it comes to this metric.

Figure 3: Employee to Aircraft Ratio of Public Airlines

Amongst Public Airlines, Turkish Airline is the most efficient with 23 employees per aircraft. Even amongst Public Airlines PIA is the worst performer, with about 269 employees per aircraft. Now, for each flight that has about 250-300 passengers, there is an equal number of ground staff seeing them. This shows how inefficiently PIA is being run.

Clearly, PIA—and other SOEs—are in dire need of reform. But why hasn’t privatization been embraced?

3. Arguments against Privatization

Normally whenever privatization is discussed, there are three arguments that are presented against privatization across Media and private circles:

a) State Owned Enterprises are undervalued

b) Privatization of State Owned Enterprises is against National Interest

c) Privatization will lead to job loss

Let’s evaluate these arguments based on evidence.

a. State Owned Enterprises are undervalued

In 2005 there was an offer to buy steel mills for Rs 17 Billion, but public outrage and Supreme Court intervention stopped the deal.

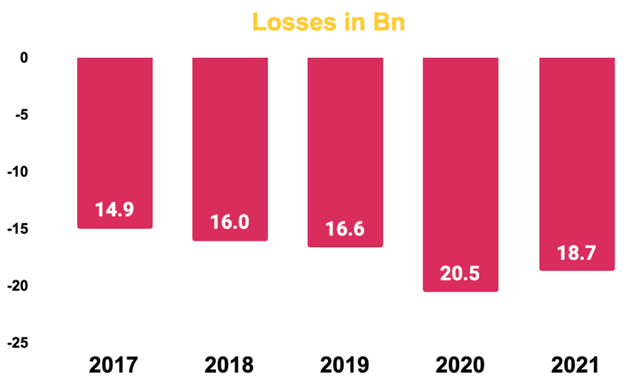

Figure 4: Steel Mills Net Loss 2017 – 2021

Since then, Steel Mills has accumulated Rs 600 billion in losses, and has not been operational since 2915.. Yet, they have accumulated a loss of about Rs 87 Billion between 2017 to 2021.

Had the privatization gone through, the government would have secured Rs 17 billion at that time and avoided the Rs 600 billion in losses that followed.

b. Privatization will lead to National Security Risk

Another common concern raised against privatization is the perceived risk to national security. But would privatizing steel mills really impact national security? Steel is already produced by several private companies in Pakistan without any issues.

Similarly, would privatizing PIA compromise national security? If that were the case, private airlines like Air Blue and Fly Jinnah wouldn’t be operating in Pakistan. Clearly, these private companies pose no threat to national security.

In many developed countries, critical infrastructure like dry ports, airports, and seaports are outsourced to private companies without jeopardizing security. This shows that the majority of services can be privatized without impacting national security.

c. Job Loss and Efficiency of State Owned Enterprises

Critics often claim that privatization leads to job losses and inefficiency. However, real-world examples of successful privatizations in Pakistan paint a different picture.

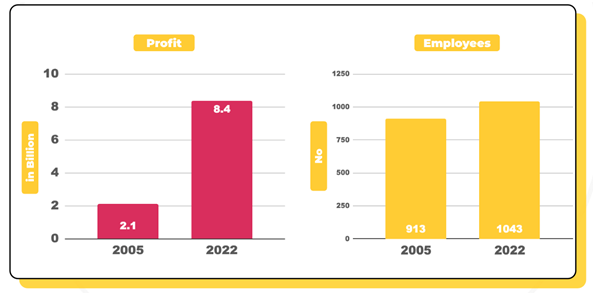

Figure 5: National Refinery Profit & Employees

National Refinery was privatized in 2005, at which time it generated a profit of Rs 2.1 billion and employed 913 people. By 2022, its profits had surged to Rs 8.4 billion, and its workforce had grown to 1,043 employees.

Figure 6: MCB Bank Profit & Employees

Similarly, MCB Bank’s controversial privatization in 1990 marked a major turnaround. Back then, the bank reported a modest profit of Rs 0.04 billion with 13,000 employees. By 2022, its profits skyrocketed to Rs 32.7 billion, with a workforce of 14,000.

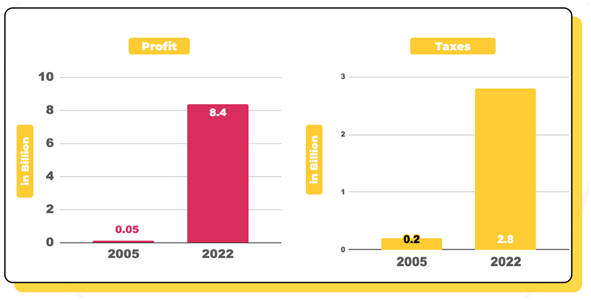

Karachi Electric (KE) offers another striking example. Unlike most distribution companies in Pakistan, which are state-run and plagued by financial mismanagement—such as QESCO and PESCO, two of the country’s largest loss-making SOEs—KE was privatized in 2005. At the time of privatization, KE’s profit was just Rs 0.05 billion, and it paid Rs 0.2 billion in taxes. By 2022, KE had achieved a remarkable turnaround, reporting Rs 8.4 billion in profits and contributing Rs 2.8 billion in taxes.

Figure 7: Karachi Electric Profit & Employees

A key performance metric for distribution companies is Transmission and Distribution (T&D) losses. Before privatization, KE’s T&D losses were a staggering 34%, meaning 34 MW out of every 100 MW generated was wasted or stolen. Since privatization, these losses have been reduced to 15%, all while operating in Karachi, a city known for its law and order challenges.

These examples clearly demonstrate how privatization leads to greater efficiency, resulting in higher profits, more jobs, and increased tax contributions.

4. Role of Government

So, should the government stay in business? Based on the evidence, the answer is largely no—except when the private sector is unable to provide essential services. In such cases, the government might step in to ensure:

a. Transport

There may be routes that are not profitable enough for private companies to operate. In such cases, where the private sector is unwilling to provide the service, the government can step in to ensure these routes are covered.

b. Utilities in Rural Area

Similarly, the private sector might be reluctant to extend essential utilities like power, water, or telecommunications to rural areas. In these instances, it becomes justified for the government to step in and ensure these services are provided.

c. Health and Education

Health and education are fundamental rights for every citizen. If the private sector cannot adequately provide these services, it becomes the government’s responsibility to step in and ensure access for all.

5. Conclusion

Privatization is clearly necessary for Pakistan’s financial well-being. Although there are challenges—particularly political resistance—privatization offers a path to reducing losses, improving efficiency, and boosting economic growth. With the right political will, the benefits of privatization could help Pakistan tackle the economic challenges it faces.