Pakistan’s Fiscal Overview

- September 20, 2024

Pakistan’s Fiscal Overview

Pakistan, with its vast economic potential as the fifth most populous country in the world and a nuclear power, finds itself repeatedly dependent on foreign countries and multinational institutions like the IMF for financial bailouts. How did the country reach this point? To understand this, one must examine the Federal Budget.

Federal Budget

The Federal Budget is a detailed record of the government’s spending, revenue, and borrowing. For FY2023, the federal budget stood at approximately Rs 16 trillion, or around $65 billion.

To make this easier to understand, let’s express the budget as 100..

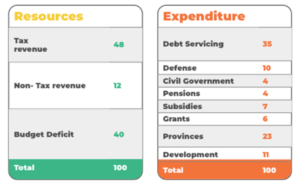

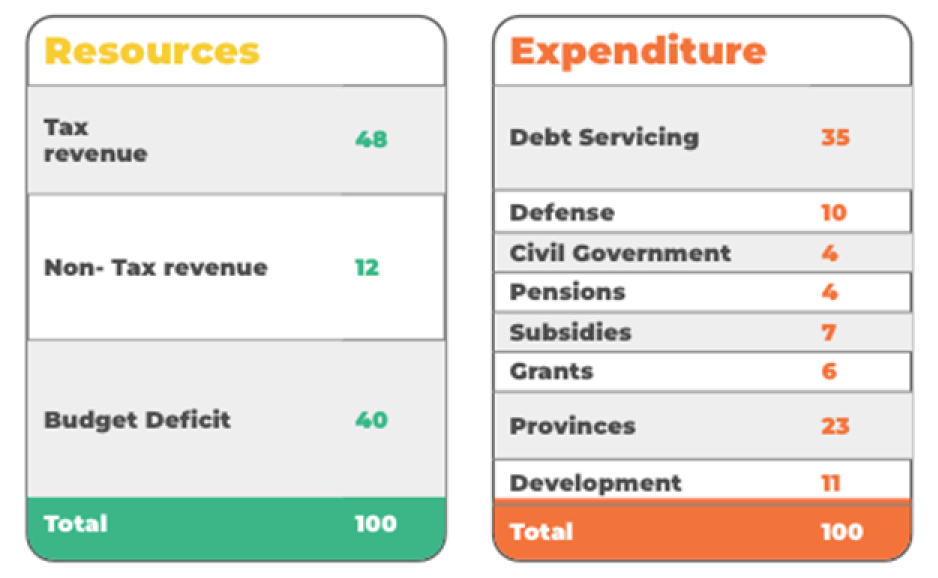

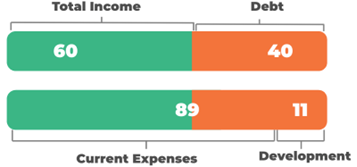

The government’s total revenue is represented as 60, with 48 coming from tax revenue and 12 from non-tax revenue sources. The remaining 40 on the resources side represents the budget deficit, which is covered by incurring new debt.

On the expenditure side, current expenses amount to 89. These include debt servicing, defense spending, civil government expenses, pensions, subsidies, grants, and transfers to provinces under the NFC award. The remaining 11 are spent on Development expenses through the Public Sector Development Fund (PSDP). While running a deficit isn’t inherently problematic, the key concern is how the borrowed funds are being utilized.

Development vs Current

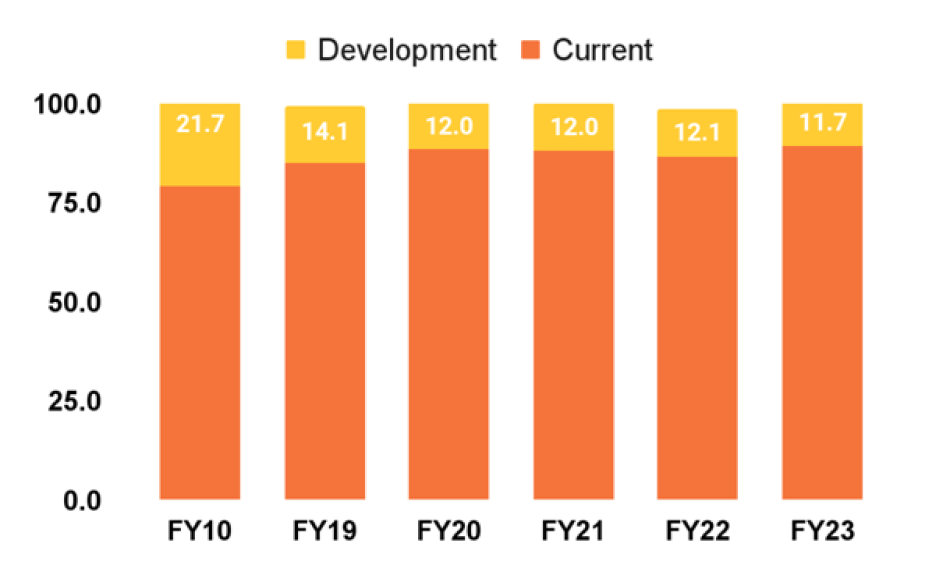

In FY2023, Pakistan allocated 89 out of 100 to current expenses, leaving just 11 for development expenditures. Development expenses are investments in activities that directly enhance the country’s social and economic growth, such as infrastructure, education, and healthcare. In contrast, current expenses are short-term costs that do not necessarily boost the nation’s economic or social potential.

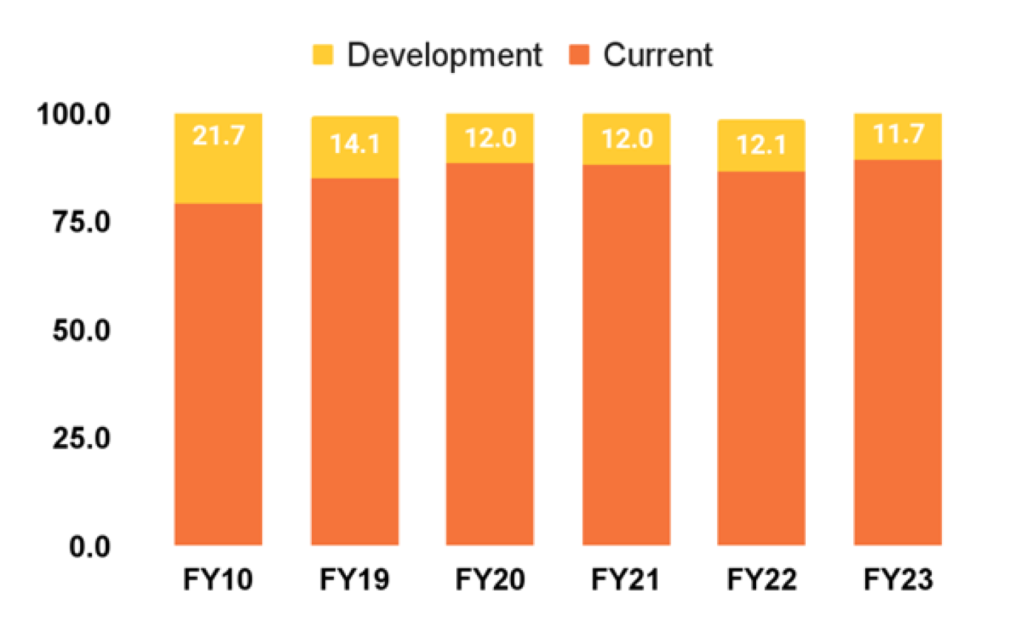

This imbalance is not a recent trend; it has worsened over time, with the share of the budget dedicated to development expenses declining from 21.7% in FY2010 to just 11.7% in FY2023.

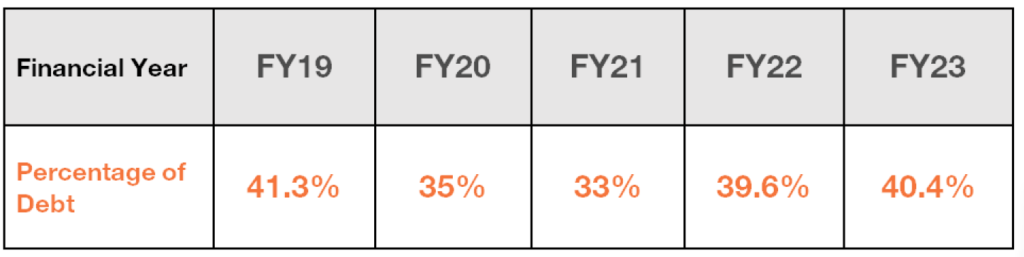

Figure 4: Pakistan’s Budget Deficit as percentage of Total Budget

High Reliance on Debt

Effectively, by the time the government covers expenses for debt servicing, defense, civil government operations, pensions, and subsidies, it has already exhausted its entire revenue.

Figure 2: Revenue and Current Expenses

As a result, every rupee spent on healthcare, education, infrastructure, and other essential services comes from borrowed money.

Since Pakistan consistently runs a budget deficit each year, it must take on additional debt annually to cover the shortfall.

Figure 3: Pakistan’s Budget Deficit as percentage of Total Budget

This persistent borrowing has caused Pakistan’s total debt to surge significantly in recent years, making debt servicing a major component of government expenditure. In FY2023 alone, 35 out of every 100 units of expenditure were dedicated to debt servicing.

While running a deficit isn’t inherently problematic, the key concern is how the borrowed funds are being utilized.

Development vs Current

In FY2023, Pakistan allocated 89 out of 100 to current expenses, leaving just 11 for development expenditures. Development expenses are investments in activities that directly enhance the country’s social and economic growth, such as infrastructure, education, and healthcare. In contrast, current expenses are short-term costs that do not necessarily boost the nation’s economic or social potential.

This imbalance is not a recent trend; it has worsened over time, with the share of the budget dedicated to development expenses declining from 21.7% in FY2010 to just 11.7% in FY2023.

Figure 4: Pakistan’s Budget Deficit as percentage of Total Budget

Impact on Pakistan’s Economy

When 40% of the budget is financed through debt, but only 11% is allocated to development, what can we expect the outcome to be?

Figure 5: Breakdown of Pakistan’s Expenses and Resources

The outcome has been a period of rapid debt accumulation coupled with slow GDP growth. Pakistan’s Debt increased at a rate of 5.5% per year in the last ten years. On the contrary, Pakistan’s GDP 10 year average annual growth rate is 3.4%. In comparison, during this period India grew at 6.2% per year and Bangladesh grew at 6.5% per year.

Categories

Subscribe Now

get notified every time we post an new episode

Related Post